In the dynamic world of cryptocurrencies, compliance has emerged as a critical factor for sustainable growth and widespread adoption. The absence of clear regulations has raised serious concerns, shaking the very foundations of the blockchain industry. It’s crucial not to underestimate the potential for illicit activities like money laundering and terrorist financing to thrive in the crypto market’s shadows.

Regulatory reporting

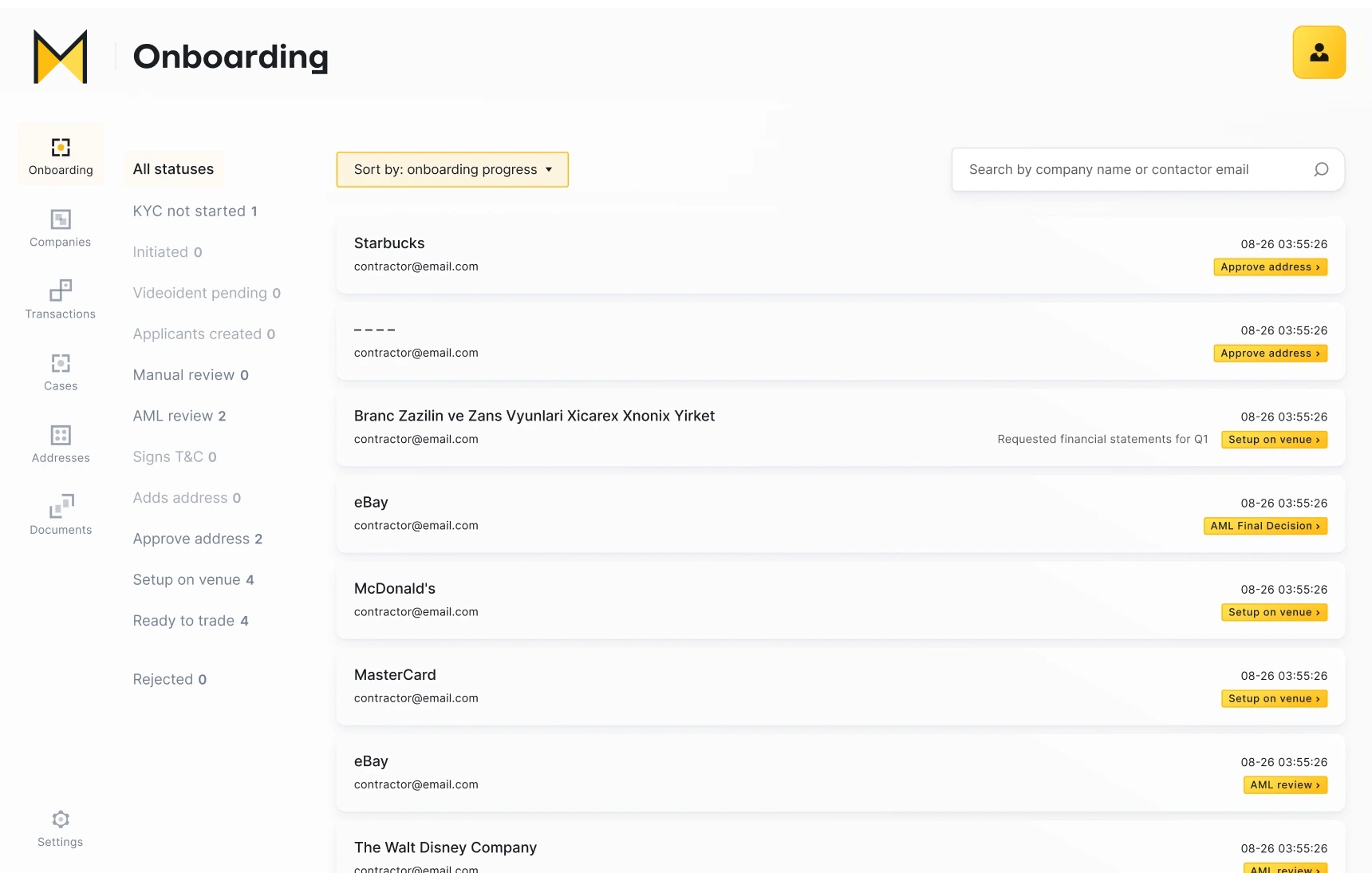

MarketGuard provides comprehensive support for regulatory reporting:

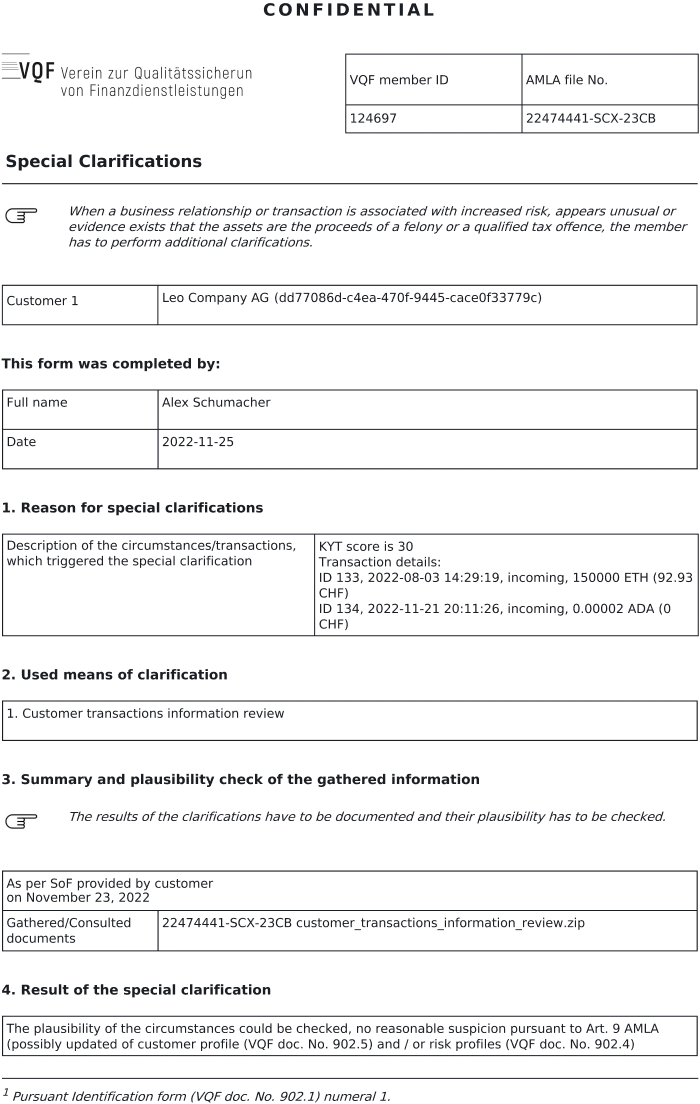

- Generate reports tailored to the specific requirements of regulatory bodies (such as VQF in Switzerland)

- Make sure regulators understand that your business is effectively monitoring and reviewing the entire flow of transactions

Our reporting system comprises data from:

- AML monitoring: detecting potential risks related to global sanctions, PEPs, and custom watch-lists, providing real-time alerts for changes in client status

- Blockchain transaction monitoring (KYT): producing a risk score based on factors such as daily/monthly limits, payment country risk, and suspicious patterns